The Only Guide to Why Is Car Insurance So High: Everything You Need To Know

California locals pay about $1,429 per year for auto insurance policy usually, making it one of the most pricey states for cars and truck insurance (vans). The state's all-natural catastrophes, theft/vandalism rates and dense population add to these greater insurance prices. The golden state drivers can take numerous steps to decrease their costs, like comparing quotes from a number of providers and browsing for price cuts.

More drivers when traveling mean even more traffic and even more accidents. Auto insurance companies in California charge much more expensive premiums to account for the greater risks of driving in the state. High Health Care Costs, It's clear that healthcare is expensive in the United States. Information from the California Health Treatment Foundation anticipates that ordinary health investing in the nation will certainly grow by 5.

business insurance insurance cheapest car insurance vehicle

3% each year. When drivers and travelers are wounded in a vehicle wreckage, insurance providers pay their clinical costs - auto insurance.

As of 2020, bringing your vehicle to a fixing shop to resolve a check engine light sets you back an average of $410. 73 in the state.

In between 2015 and 2021, annual prices increased by $119. Presently, California is the 40th most inexpensive state for car insurance coverage. Population thickness has Go to the website slightly lowered in the state in current years, an uptick in all-natural calamities and also weather-related occasions suggests that rates will likely continue to raise in the coming years. car.

The Best Guide To 5 Causes Of Insurance Premium Increases - Nationwide Blog

Acquiring home insurance policy, renters insurance or insurance coverage for numerous vehicles from the exact same carrier can be an excellent means to rack up cost savings. affordable auto insurance. 3Ask regarding price cuts. Suppliers use numerous price cuts to assist you save money on your policy, like risk-free driving, excellent pupil and also anti-theft device discount rates. car insurance. 45Consider raising your deductible. Doing so means you'll need to pay more out of pocket after an accident, yet it additionally indicates considerably lower costs.

If you don't put several miles on your vehicle, think about a pay-as-you-drive policy that determines your rate based on exactly how usually you drive - cheap car insurance. About the Author (suvs).

These rate aspects are based on elements that have actually been revealed to create greater opportunities of filing a car insurance case, not arbitrary elements (car insurance). When buying auto insurance, you are not asked to submit the color of your car, so it's not a contributing element.

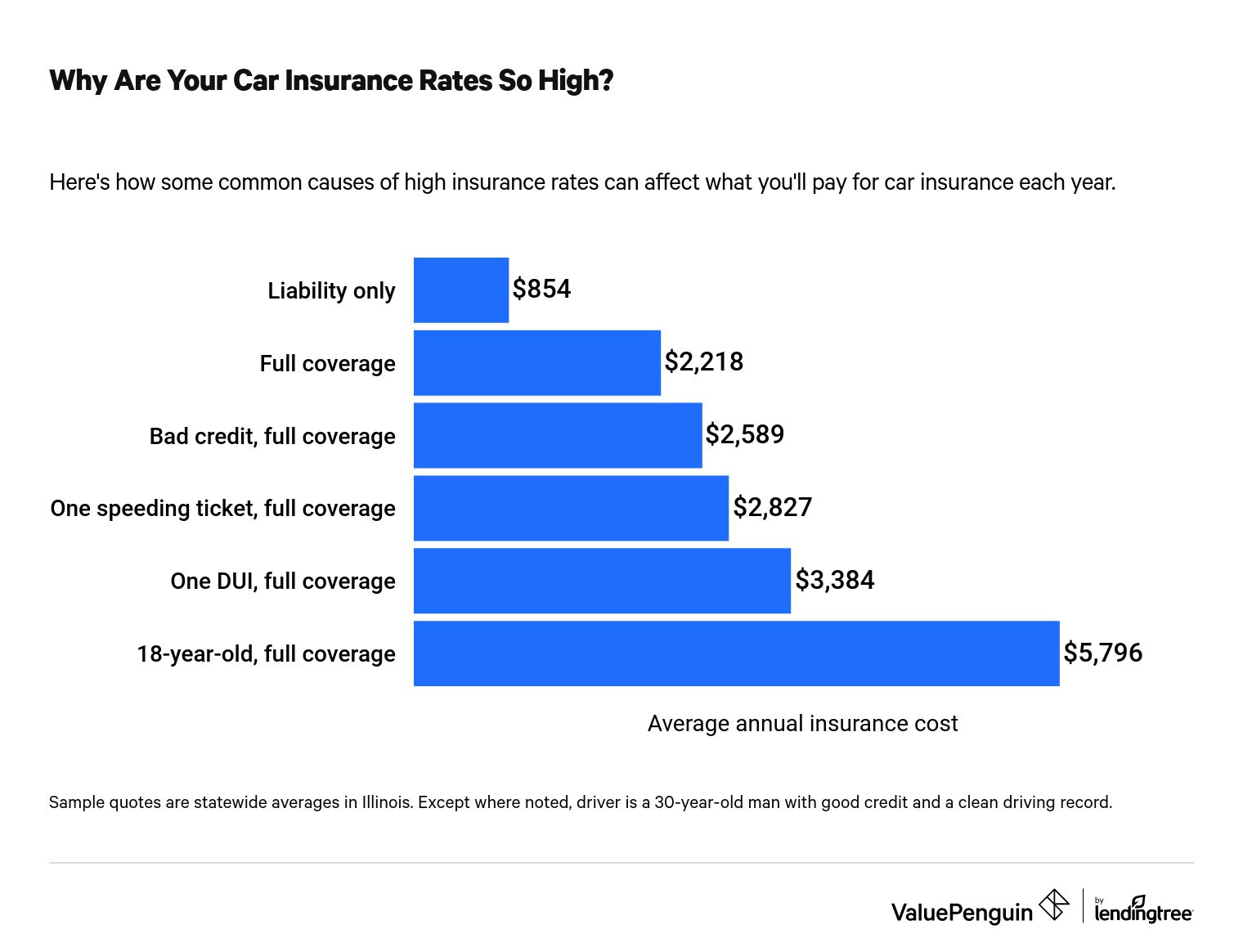

If you have a reduced credit report, this influences your auto insurance policy rating as well as for that reason boosts the costs you pay (insurance).: the much more coverage you have, the a lot more your automobile insurance coverage rate will certainly raise. Most states require you to have their lawful limitations of responsibility insurance. If you choose complete protection auto insurance policy, you can anticipate to pay more.

cheaper auto insurance cheapest auto insurance risks insurance affordable

The state you live in is a big one - insurance.

The Definitive Guide for Why Does My Car Insurance Go Up As My Car Gets Older?

car insurance car insurance insurance affordable cheap car

Chauffeurs age 65 and also older pay greater than chauffeurs in the 25- to 65-year-old array as a result of reaction time decreasing as you obtain older - money.: if you stay in a postal code that has a high rate of auto burglary, your auto insurance coverage prices may enhance as a result. insurance.: if your next-door neighbors have actually submitted several automobile insurance policy asserts in the past, that can equal a high-risk circumstance and higher premiums.

A lot more vehicles mean higher chances of an accident. This indicates greater prices. Just how to lower your car insurance coverage price Whether you're checking out high insurance policy rates or not, there are a variety of methods via which you can assist reduce your expenses. These include: Compare car insurance policy prices quote A terrific method to conserve money on automobile insurance coverage is to contrast quotes from multiple automobile insurer.

This can decrease your vehicle insurance coverage premium, and potentially the premium of the other policy, also. Take benefit of discounts Several car insurance policy suppliers remain competitive by providing price cuts for automobile insurance coverage. When comparing quotes, make certain to discover all the price cuts you receive. Elevate your deductible If you can afford to pay even more in the event of a case, think about increasing your deductible.

car auto dui liability

Go down unneeded insurance coverage In time, you might discover that your car insurance policy protection needs an update. As an example, if you market your cars and truck but still require to hold onto obligation insurance for when you do drive, you can drop full-coverage insurance coverage if you have it and also save cash. LLC has made every initiative to ensure that the details on this site is appropriate, but we can not guarantee that it is devoid of inaccuracies, errors, or noninclusions.

Quote, Wizard. com LLC makes no depictions or warranties of any type of kind, reveal or implied, regarding the procedure of this site or to the details, material, materials, or products included on this website. You expressly agree that your use of this website goes to your sole danger.

Little Known Facts About 9 Major Factors That Affect The Cost Of Car Insurance.

dui car insured auto insurance vehicle insurance

https://www.youtube.com/embed/GELKS0rZrHI

Why Is My Car Insurance Policy So High? Truthfully, there might be a couple of factors why you're paying so a lot for auto insurance policy.